After a ‘shambolic’ start to the budget announcement today the chancellor has insisted she retains full confidence in Richard Hughes, the head of the Office for Budget Responsibility (OBR), after the fiscal watchdog ‘accidentally’ published its economic forecasts online ahead of today’s Budget. The incident was described as a “technical error” after the OBR apologised for the early release. The link was later removed, but not before MPs, journalists, and investors had already begun analysing the document.

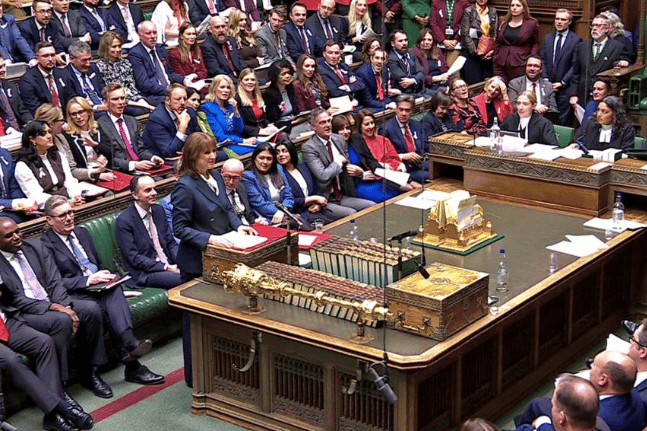

The leak created an unusual atmosphere in the Commons, with several MPs seen studying graphs and tables on their phones as the chancellor delivered her Budget speech.

Reeves confirmed that income tax and National Insurance thresholds will remain frozen until 2031, extending the freeze by a further three years beyond the timeline set by the previous Conservative government. Reeves acknowledged the impact this would have on working people but said it was necessary to stabilise the public finances. The OBR estimates the measure will bring 780,000 more people into paying income tax in 2029–30.

New tax measures dominated the statement, including the introduction of an annual 3p-per-mile charge for electric vehicles and 1.5p for plug-in hybrids from April 2028, the first year revenue will be collected. Reeves said this would help double road maintenance funding in England and contribute £200m to expand electric charging infrastructure. The OBR forecasts the duty will raise £1.4bn in 2029–30.

Reeves also announced changes to gambling taxation, raising Remote Gaming Duty from 21 per cent to 40 per cent and increasing duty on online betting from 15 per cent to 25 per cent. The government expects the reforms to raise more than £1bn a year by 2031.

Bingo Duty will be abolished from April 2026. Elsewhere, more than 750,000 retail, hospitality and leisure properties will see business tax reductions, funded by higher rates on properties valued above £500,000.

Property owners at the top end of the market will face new so-called “mansion tax” charges in England, with levies ranging from £2,500 on homes valued between £2m and £2.5m to £7,500 for those worth more than £5m. The OBR states the surcharge will raise £0.4bn in 2029–30 and will apply to fewer than one per cent of properties. A £2,000 cap will also be placed on pension salary sacrifice schemes from 2029, with the OBR forecasting £4.7bn will be raised in 2029–30 and £2.6bn in 2030–31.

Reeves criticised the Conservatives for “doubling the national debt”, stating that net financial debt now stands at £2.6tn. She said her fiscal rules will return the UK to a budget surplus of £3.9bn in 2028–29, adding that borrowing must fall while investment continues. Reeves told MPs that inflation will be 0.4 percentage points lower next year, although the OBR does not attribute the change to specific government policy.

Budget at a Glance:

- Income tax and National Insurance thresholds frozen until 2031.

- New EV mileage duty from April 2028: 3p per mile for electric cars and 1.5p for plug-in hybrids.

- Remote Gaming Duty rising from 21% to 40% and online betting duty from 15% to 25%; Bingo Duty abolished in April 2026.

- Lower business tax rates for more than 750,000 retail, hospitality and leisure properties, funded by higher rates on properties worth over £500,000.

- Surcharge on homes worth more than £2m, raising £0.4bn in 2029–30.

- Pension salary sacrifice contributions are capped at £2,000 from 2029, with amounts above taxed normally.

- £5m for secondary school libraries and £18m for upgrading playgrounds across England.

- £820m across the forecast period for a “youth guarantee” offering apprenticeships, training or work placements for 18 to 21-year-olds.

- Removal of the two-child benefit limit from April 2026.

- National minimum wage rise confirmed; 18-20 Year Old at a rate of £10.85 and National Living Wage (21 and over) £12.71

- 5p cut in fuel duty extended until September next year.

- Household energy bills to fall through cuts to green levies.

-Cleared.jpeg?width=209&height=140&crop=209:145,smart&quality=75)

Comments

This article has no comments yet. Be the first to leave a comment.